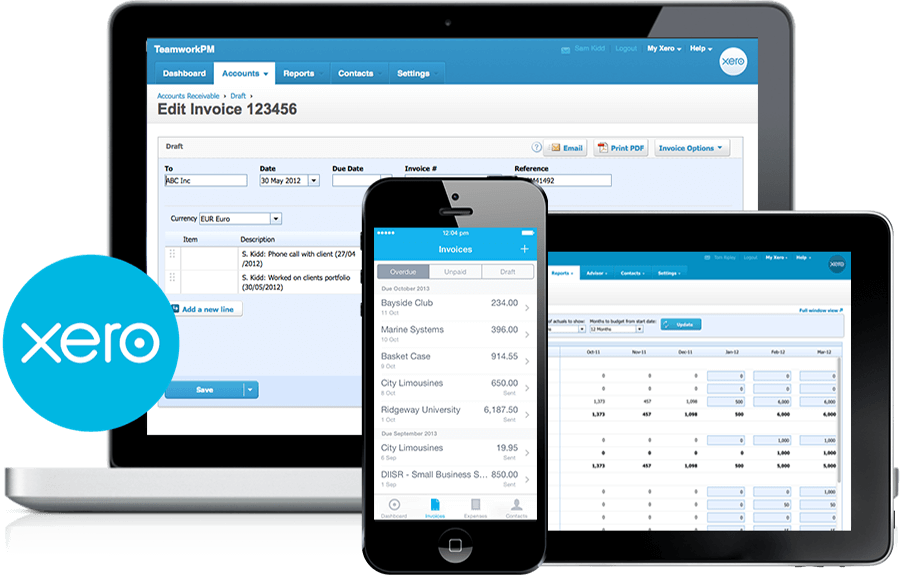

In presenting the five issues Xero solves, I am talking initially at a very general level. The great thing about a tool that is as powerful as Xero is there are many additional add-on features which you can access to more particularly address your needs.

At a base level, there are many common issues businesses share. The days of operating on spreadsheets alone and independently creating invoices are not just old-fashioned, but it is inefficient. The list below reflects how much easier it can and should be to stay on top of your business finances.

Top five business issues Xero solves:

1. Cashflow – helping collect debts

Take for example when you send an invoice to a customer, at a basic level you want to know the date it was sent, who and which email you sent it to, and when they actually opened the email. You also want to trace your email correspondence with that customer. Xero can track all this easily, with each invoice generating an order trail around it producing all the information you need. You can also create a payment service which is attached to the invoice so the customer could pay immediately. There is also automatic email reminders for overdue invoicesAll the above information make it easier to collect money

2. Employee paid accuracy and compliance is paid

In Xero, Payroll can link employees so they can view their payslips, the leave they have taken and when they plan to take their next break. It is all interfaced so they can communicate with the company and your payroll office very easily. Xero create PAYG activity statement s and BAS reports. Xero makes it easy to pay employees and ensure that the payroll compliance is accurate

3. Stakeholder access – Single source of the truth

Any of your advisers (bookkeepers, accountants, financial planners, etc.) can have a link to your Xero file. This simplifies communication between stakeholders as they can focus on solving the problem as opposed to looking at different versions of the numbers You can limit their access, giving them specific permissions as to what they can view or change. It is worth noting there is security around it; you have an assurance dashboard where you can look at what type of transaction that person has done and when they came into the file.

4. Paying suppliers accurately and on time

Your connection with suppliers is incredibly important, and their details need to be easily accessible and checked. The suppliers bill could be attached to the Xero transaction so paying the supplier is transparent as Xero enables you to quickly answer questions such as:

• How many suppliers have the same bank details?

• Was there a lost invoice?

• Are there any invoices backdated by more than 30 days?

• What was processed in the bank transactions?

Much like with adviser checks, there are plenty of security measures to ensure that suppliers are paid accurately and on time.

5. Integrity of the information

Another example of how to make the most out of Xero is with bank fees. A feed from your bank accounts ensures what’s going through the bank is matched exactly to your account transactions. This ensures that the Xero file is accurate as it’s transactions are match to the bank statement.

When using Xero features correctly, Xero reduces the time you need to spend on managing connections. It enables business owners to get the most out of the information they collect and focus on what they do best. Business owners need to focus more on generating revenue as opposed to creating or measuring it, not to mention the opportunity costs associated with this administration.

The question now is not how to make the most out of Xero, but why aren’t you doing it?

Contact us today for a free 30-minute consultation, so we can help you determine what you need to do to focus more on growing your business.